Diminishing value depreciation example

For example assume a company has an investment in Company A bonds with a carrying amount of 37500. Includes formulas example depreciation schedule and partial year calculations.

Depreciation Schedule Formula And Calculator

Written-down value is the value of an asset after accounting for depreciation or amortization and it is also called book value or net book value.

. The book value of an asset is obtained by deducting depreciation from its cost. The Indian rupee breached the psychologically significant exchange rate level of 80 to a US dollar in early trade on Tuesday. These are expenses that do not affect the cash flow of a given period.

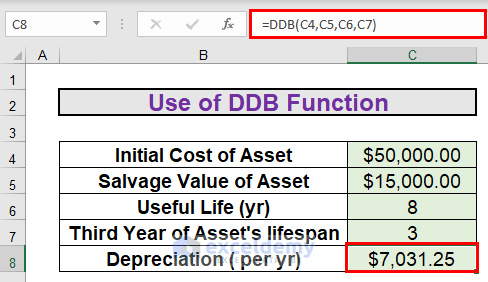

The base value of an asset is broadly its cost plus any costs incurred on the asset since you first held it say on improvements less the decline. For example a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. Assets acquired since 10 May 2006 may use a diminishing value rate equivalent to double the prime cost rate.

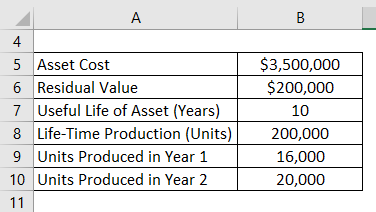

The effective life and depreciation rate for all division 40 plant and equipment assets. To calculate reducing balance depreciation you will need to know. The diminishing value method uses the cars base value to calculate depreciation.

The depreciation charge is first applied to the initial cost of equipment and then to its diminished value. The difference in the value of accounting depreciation and economic depreciation should be adjusted from the capital employed. 80000 365 365 200 5 80000 40 32000.

Foreign exchange contracts are reported at fair value as on the reporting date. Depreciation has been defined as the diminution in the utility or value of an asset and is a non-cash expense. To calculate depreciation for most assets for a particular income year.

Existing depreciation rules apply to the balance of the assets cost. Read more with the help of an example. For example consider.

It represents the amount of value. When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period here 1235 and the Salvage Value 500. Calculating the decline in value of assets in a low-value pool.

Detailed 40 year forecast illustrating all depreciable items. In the diminishing value method for calculating the depreciation the depreciation charge is made every year at a fixed rate on the diminished value of the equipment ie. When you buy the item its book value is its cost value.

Depreciation rate Depreciation expense Accumulated depreciation. Income is the consumption and saving opportunity gained by an entity within a specified timeframe which is generally expressed in monetary terms. This kind of depreciation method is said to be highly charged in the first period and then subsequently reduce.

Declining Balance Method Example. The original value of the asset plus any additional costs required to get the asset ready for its. Diminishing Value Method of Depreciation.

In generic term depreciation is the decrease in value. So in this example you would record year threes depreciation as 735. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule.

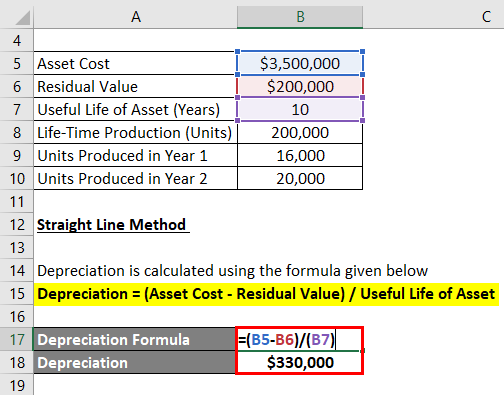

Both prime cost and diminishing value methods of depreciation to help you decide which method is best for you. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. Base value includes its initial purchase cost and other costs incurred on the car since purchase.

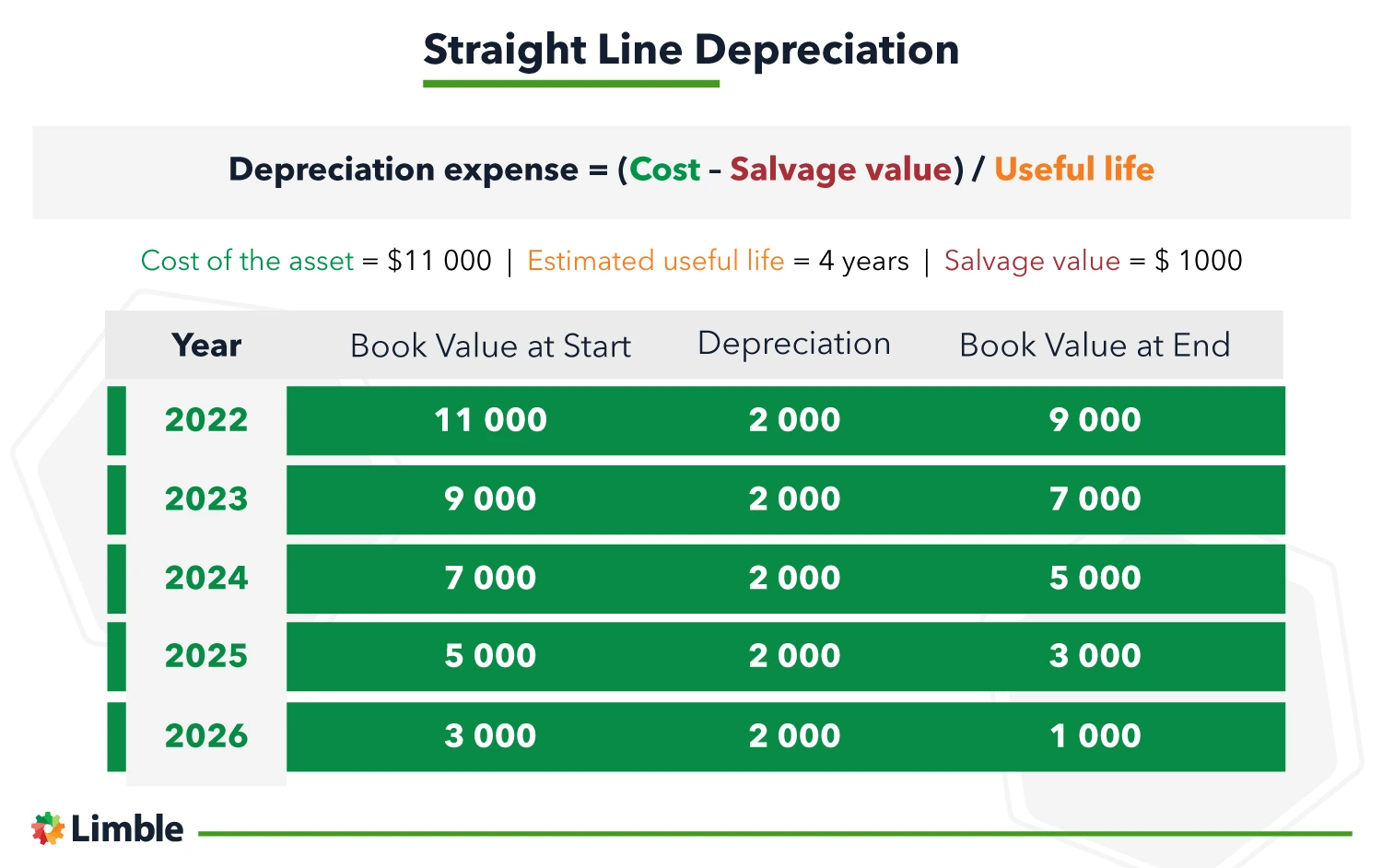

Since the depreciation rate per cent is applied on reducing balance of asset this method is called reducing balance method or diminishing balance method. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value. Impairment of assets is the diminishing in quality strength amount or value of an asset.

Cost value 10000 DV rate 30 3000 depreciation to claim in your tax return The remaining 7000 is the espresso machines adjusted tax value to use in next years return. The formula for the calculation is. There are growing concerns about how a weaker rupee affects the broader economy.

The depreciable cost of motor vehicle is subject to the Luxury Car Limits which assumes an upper limit on the cost on which depreciation is calculatedIf the vehicle costs more than the limit depreciation is only. It is calculated by subtracting accumulated. If you are using the simplified depreciation rules for small business you can claim 575 of the cost of the asset in the first year you add the asset to the small business pool.

Income is difficult to define conceptually and the definition may be different across fields. Book value cost value annual depreciation x age For example if your item cost you 20000 five years ago and you depreciate 2000 for it every year its book value would be 10000 meaning that in your financial books the item is worth 10000 after five years of use. The depreciation charge is smaller than if the original non-current asset value had been used.

The calculation of depreciation. Depreciable base cost. Deduction of 50 of the cost or opening adjustable value of an eligible asset on installation.

Lets understand the same with the help of examples. Reducing balance depreciation is also known as declining balance depreciation or diminishing balance depreciation. Reducing Balance Method Formula.

Depreciation Expense Book value of asset at beginning. This is because the charging rate is applying to the Net Book Value of Assets and the Net Book. This ensures that depreciation is charged in full.

Car Depreciation Cost Limit. Base Value x Days owned 365 x 150 Effective life in years This formula is for vehicles acquired prior to May 10 2006. The entity assesses that the asset will be used for 5 years with most of.

An example is a repayment mortgage on a house which is amortised by making monthly payments that over a pre-agreed period of time cover the value of the loan plus interest. With loans that are. Page needed For example a persons income in an economic sense may be different from their income as defined by law.

Diminishing balance depreciation with residual value Entity purchased for 12 million an item of high-tech PPE subject to increased technical obsolescence. Calculator for depreciation at a declining balance factor of 2 200 of straight line. Diminishing Balance Depreciation Method.

The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16. The book value of asset gradually reduces on account of charging depreciation. Since the war in Ukraine began and crude oil prices started going up the rupee has steadily lost value against the dollar.

A BMT depreciation schedule includes the following components. If the asset cost 80000 and has an effective life of five years the claim for the first year will be. It recovered some ground to close at 7990.

Under the diminishing value method the decline in value is calculated using the assets base value. How to calculate reducing balance depreciation. An example of Depreciation.

According to Reducing Balance Method the percentage at which depreciation is charged remains fixed and the amount of depreciation goes on diminishing year after year. Lets understand the differences between WDV and Straight-line depreciation Straight-line Depreciation Straight Line Depreciation Method is one of the most popular methods of depreciation where the asset uniformly depreciates over its useful life and the cost of the asset is evenly spread over its useful and functional life.

Written Down Value Method Of Depreciation Calculation

Ujlmkhhzny147m

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Cash Flow Statement Templates

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Straight Line Vs Reducing Balance Depreciation Youtube

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

Download Cagr Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense